January 2023

LETTER OF VALUE

Ruminations for investors seeking to enhance their wealth using the principles of VALUE INVESTING

To Our Business Partners

As you know, we write to you monthly to share our thoughts on big-picture topics that are front of mind for us, as well as to provide you with updates on portfolio valuation and recent results. We now like to take the opportunity through this year-end letter to “reintroduce” Warnke/Nichols and remind you all of what makes us tick.

WHO WE ARE

Our mission is to provide clients with satisfactory long-term investment results through the consistent application of an absolute, not relative, VALUE-oriented philosophy to achieve the highest return on investment consistent with preservation of capital. Absolute value investing is the process of buying an asset at a price substantially below its estimated worth, also commonly referred to as intrinsic value.

The value of any business is determined by how much cash it produces for the owner(s) over the life of the business. Intrinsic value is today’s estimated total of a company’s future cash flows using an appropriate rate of return – 12% in our case. This is called the Discounted Cash Flow (DCF) method of valuation – a process used by most appraisers in valuing a business, building, rental property, or machine.

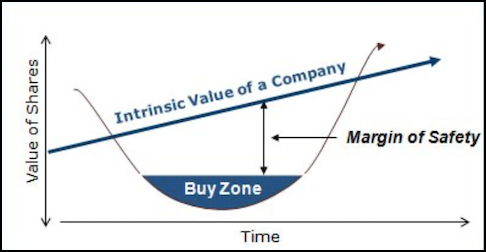

In addition to the DCF valuation method, we use stock price-to-earnings, price-to-sales, and price-to-book (asset value) methods to calculate intrinsic value. This then gives us a range of estimated values for a company. We will buy the company’s stock only if its market price is two-thirds or less of what we estimate to be its intrinsic value. This MARGIN OF SAFETY minimizes the possibility of suffering permanent capital loss due to analytical error, miscalculations, or bad luck. Over time your wealth increases as the stock price moves up toward the company’s rising business value. Here is a perfect representation of the intrinsic value process:

However, valuation is just one part of the decision whether to buy a stock. We will not buy a company simply because it is cheap. We also conduct a qualitative assessment of each business. Dozens of academic studies over the last 100 years, plus our own cumulative 100+ years of investment experience, confirm that certain business characteristics are associated with exceptional long-term results and low risk in the stock market, provided the companies are bought with a margin of safety. Our rigorous and highly disciplined in-house research seeks to identify investment candidates with the following characteristics:

- Growing & Highly Profitable. Prospective companies have a track record of sales growth through organic means, i.e., not acquisition-driven, and earn a high return on invested capital (ROIC) through a cycle. ROIC is the amount of money a company makes relative to the amount of debt and equity capital invested in the business. A company is creating value when its profitability – ROIC – is greater than the cost of the capital it employs.

- Financially Strong. The best companies have low debt, high levels of free cash flow, and ample liquidity. All companies incur business risk and are cyclical in nature — some more so than others — and we do not want to amplify business risk by taking on financial risk.

- Easy to Understand. Oftentimes the best stocks are the ones whose businesses are least complicated. If we open the annual report and cannot understand the business, then we pass. One does not get extra points for complexity.

- Owner-Operated. We look for significant stock ownership by officers and directors, and/or company repurchases of large amounts of stock below intrinsic value, and/or insider buying on the open market. Management is paid based on the achievement of organic growth and profitability objectives rather than just growth for growth’s sake. Good corporate governance is all-important.

Stock portfolios are highly concentrated in a small number of companies. A well-diversified portfolio typically contains 12 to 20 stocks. This is consistent with studies proving that beyond this number of stocks, there is no greater reward, nor lesser risk, by owning more companies. Cash is a residual of our investment process and not a function of market timing. Portfolio cash is earmarked for future purchases of companies that meet our strict criteria.

Since we generally limit ourselves to owning a maximum of 20 stocks in a typical equity portfolio, if we own this amount and decide to initiate a new position, we will then have to sell a less appealing holding to make room. By less appealing we mean a company that is being priced well above its intrinsic value and/or where the investment thesis has changed. While harvesting gains in long-held stocks results in having to pay long-term capital gains taxes in taxable accounts, this is the nature of the business.

The investment process we describe above has produced satisfactory results over a long period of time. (Our investment “track record” is available upon request.) It is important to keep in mind that stock prices and portfolio values do not move up in a straight line, however. Prices of stocks are volatile and often differ from the true worth of the underlying company. Gains or losses in portfolio value will vary from one period to the next. The market value of any individual security or a portfolio at a point in time could be more or less than the amount originally invested.

But volatility is not the same thing as risk. Rather, risk is the permanent impairment of capital. Although past performance is not indicative of future results, we would expect positive investment returns over a long period of time due to the growth of the underlying companies even though returns year-to-year can be “lumpy.”

A FINAL NOTE

This year, 2023, marks our 30-year anniversary as an independent money manager. The breakout was motivated by the desire to help investors, who might not have the time, interest, education, experience, or temperament, to protect and build their wealth our way, unencumbered by bureaucracy and lack of flexibility.

Headquartered in Delafield, Wisconsin, a city with a population of just over 7,000 located about 30 minutes west of Milwaukee, we are far away from the “noise” and herd mentality of Wall Street. It is just the three of us, with no other owners nor staff (we answer our own phones), working away in an office less than 1,700 square feet in size, and we like it fine just that way.

We cannot thank you enough for your ongoing trust and confidence. Know that as you pay us a fee to manage your investments, and a significant portion of our net worth is invested alongside you, our financial interests are directly aligned with yours.

We look forward to continuing to communicate with you through our writings, conversations over the phone, and in-person meetings. In the meantime, we wish you all a happy, healthy, and prosperous New Year!

Investors should always keep in mind that the most important metric is not the returns achieved but the returns weighed against the risks incurred. Ultimately, nothing should be more important to investors than the ability to sleep soundly at night.

— Seth Klarman, Baupost Group

Andy Ramer, CFA • Bill Warnke, CFA • Steve Nichols, CFA

For more information, including complete performance history, fee schedule, and SEC Brochure, contact us at value@warnkenichols.com

262-303-4113

440 Wells Street #203, Delafield, WI 53018

WarnkeNichols.com