Capital Gains + Dividends

Investment performance is measured by the percentage rate of increase in your portfolio over time. Rate of return is the sum of capital gains, dividends, and income, minus management fees. Think of it as hiring us (for a fee), to plant a grove of fruit trees (the portfolio) that grow over the years (capital gains) and, at the same time, yield more and more fruit (dividends and income), the seeds of which can be planted to grow more trees and fruit.

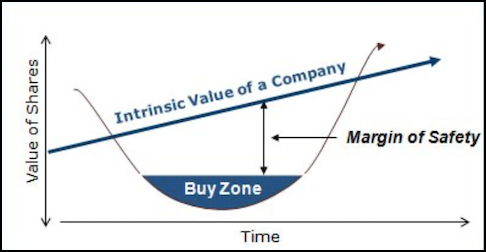

SATISFACTORY LONG-TERM RETURNS ON INVESTED ASSETS. Companies raise money by selling ownership interests — shares of stock — to the public. As the companies grow and become more valuable over time, the prices of the stocks usually follow suit. By owning shares in a small group of profitable, financially sound, growing companies, your invested capital grows, ESPECIALLY if you can purchase the stocks below what they’re truly worth. Over time, your wealth increases as stock prices move up toward their companies’ rising business values.

PRESERVATION OF CAPITAL. You preserve your invested assets and minimize the risk of permanent loss by owning stocks of a diversified group of financially strong companies that are purchased at significant discounts to conservative estimates of underlying worth. In other words, buy great companies at bargain prices! The favorable difference between WHAT YOU PAY and WHAT YOU GET is called the MARGIN of SAFETY. A large margin of safety minimizes the possibility of suffering permanent capital loss due to analytical error, miscalculations, or just plain bad luck.

Long-Term Returns on Investment

LOW COSTS AND TAX EFFICIENCY. Your investment performance is enhanced by minimizing the costs of ownership. Long-term ownership of common stocks leads to long-term capital gains, which are taxed at lower rates. Infrequent buying and selling helps you minimize brokerage commissions. Finally, your investment manager, who charges a reasonable management fee, is incented to grow your portfolio value over time. Therefore, your manager’s financial interests are directly aligned with yours.

INVESTMENT RISKS. Publicly traded securities, especially stocks, are risky. Positive investment returns are highly likely over a long period of time due to the growth of the underlying companies but returns year-to-year can be “lumpy” and are never guaranteed.

In addition, investors must remember that prices of stocks are volatile and often differ from the true worth of the underlying company. Gains or losses in portfolio value will vary from one period to the next. The market value of any individual security or a portfolio at a point in time could be more or less than the amount originally invested. Permanent capital losses might occur if securities are sold below original cost. Of course, past performance is not necessarily indicative of future results.

Basically, price fluctuations have only one significant meaning for the true investor. They provide him with an opportunity to buy wisely when prices fall sharply and to sell wisely when they advance a great deal. At other times he will do better if he forgets about the stock market and pays attention to his dividend returns and to the operating results of his companies…