Two Asset Classes: Stocks and Bonds

The Essence of Value Investing

Depending on each client’s unique situation, guidelines, and objectives, we invest in stocks for long-term growth of capital, and fixed-income securities (bonds) for income and stability of capital.

STOCKS.

Stocks are truly ownership interests in businesses. Dozens of academic studies over the last 100 years, plus our own cumulative 100+ years of investment experience, confirm that certain business characteristics are associated with exceptional long-term results and low risk in the stock market.

Through our rigorous research and business appraisal process, clients’ individually managed portfolios hold 12-20 companies that possess one or more of the following traits:

- Deeply undervalued. Selling at low prices in relation to their companies’ earnings, assets, cash flow, dividends, and estimated worth.

- Highly profitable. Consistently earning high returns on invested capital.

- Financially strong. Ample liquidity, high levels of free cash flow, and low debt in relation to invested capital.

- Owner-managed. Significant ownership by officers and directors and/or company repurchases of large amounts of stock below intrinsic business value.

- Seasoned companies. Track records of profitability.

- Significant decline in stock price prior to purchase.

We choose stocks through a rigorous, highly disciplined research process. For each company of interest, we estimate what it’s truly worth using a business appraisal process. We thoroughly analyze a company’s financial statements to evaluate profitability, financial soundness, and prospects for growth in sales, earnings, equity, cash flows, and dividends.

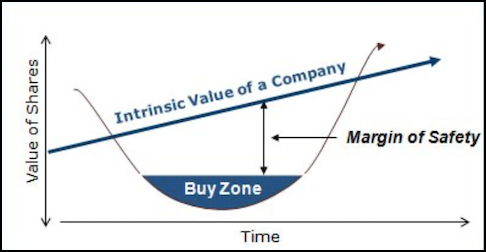

The price you pay for any asset determines its margin of safety and future returns. Accordingly, we will buy a stock only if its current market price is less than 2/3 of what we estimate to be the worth of its underlying business – THE INTRINSIC VALUE – providing the company meets the tests of financial soundness, profitability, and growth prospects.

There is a close connection between margin of safety and diversification. Stock portfolios are highly concentrated in a small number of carefully chosen companies. A well diversified stock portfolio typically contains 12-20 stocks among 10-12 different industries.

BONDS. Fixed-income securities are bought in accordance with a passive, laddered maturity approach. Selection criteria include high liquidity (easily bought in the marketplace); high quality (according to the leading rating agencies); and relatively short maturities (10 years or less). Purchase candidates include U.S. Treasury and Agency issues, bonds issued by financially sound industrial or financial companies, and tax-exempt municipal securities.