Value Investing

… is the process of buying an asset at a price substantially below its estimated worth, to achieve the highest return on investment, consistent with preservation of capital.

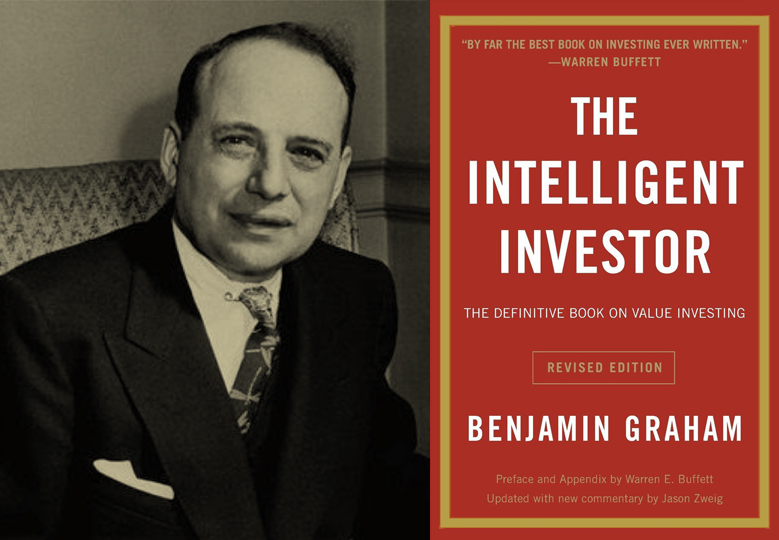

VALUE INVESTING has produced exceptional results in the stock market since the early 1920s. This investment philosophy is based on proven principles pioneered by Benjamin Graham and advanced by seasoned investors like Warren Buffett of Berkshire Hathaway Inc., Seth Klarman of Baupost Group, and the principals of Tweedy, Browne LLC, a 100-year-old investment company. Buffett, arguably the world’s most successful stock market investor over the past 65 years, was Graham’s most gifted student and business partner.

An investment operation is one which, upon thorough analysis, promises SAFETY OF PRINCIPAL and a SATISFACTORY RETURN. Operations not meeting these requirements are speculative…

“SAFETY OF PRINCIPAL.” You preserve your invested capital by owning stocks of a diversified group of financially sound companies bought at bargain prices. The favorable difference between a stock’s price and its estimated worth is called MARGIN OF SAFETY. The safety margin minimizes the possibility of suffering permanent capital loss due to analytical error, miscalculations, or bad luck.

“SATISFACTORY RETURN.” Your invested capital grows by owning a small group of profitable, growing companies at prices considerably below the estimated worth of their underlying businesses. Over time, your wealth increases as stock prices move up toward their companies’ rising business values.

Confronted with a challenge to distill the secret of sound investment into three words, we venture the motto, MARGIN OF SAFETY…